Healthcare in the US

The following information is shared in partnership with the US OUTCAN Health Services Team. For any questions about the content, please reach out to the Health Services Team directly.

Healthcare Survey

Have you experienced challenges with PSHCP healthcare claims? The Health Services team wants to know! Help break down barriers to care for the U.S. OUTCAN community. Take this short surveyCore Documents

Healthcare in the US

Healthcare in the US

An all-encompassing document to help you navigate the US Healthcare System. Topics include clearing in, accessing care, claims, and more.

Dependant Aide Guide | Member Aide Guide

Summarized extensions of Healthcare in the US

Helpful Hyperlinks

- Canada Life Portal: PSHCP positive enrollment, personal information updates, and PSDCP claim submission

- MSH International Portal: OUTCAN PSHCP comprehensive policy claim submissions

- TRICARE Website: Confirm coverage/copays, find MTF information and/or a network provider

- MHS Genesis Portal: DoD Health Information System, medical records, prescriptions, lab results, appointments

- Humana Website: Eastern US; TRICARE claims and referral management

- Health Net Fed Services: Western US; TRICARE claims and referral management

Bulletins & FAQs

-

PSHCP Administrator Dispute Escalation

CAF Members posted OUTCAN USA continue to experience issues encountered with PSHCP; specifically from the administrators of Canada Life and MSH International, resulting in customer service deficiencies, delayed or denied claims and other systemic issues. Escalation via PSHCP Administration Authority remains an option, though the CAF has continued to find avenues to escalate your issues and have them addressed in a timely manner. We continue to advocate specifically for DND, our members and their families.

If you have been experiencing issues that have not been resolved by interacting directly with MSH International or Canada Life, there is now a process to identify this issue directly to the DND Plan Manager. Examples of reasons to escalate include but are not limited to;

- Claims denied in contravention of the PSHCP Directive;

- Claims processing times in excess of 90 days without explanation;

- Improper reimbursement;

- Personal or Banking Information errors not resolvable by MSH/ Canada Life Customer Service;

- Entitlement or coverage errors not amendable by CAF HR; or

- Portal access issues not resolvable by MSH International/ Canada Life Customer Service.

To begin the process, please DOWNLOAD, complete, and submit the PSHCP Administrator Dispute Escalation form. Note that the submit button on the form will function correctly only after it has been downloaded. Some issues may fall within CAF Pay and Admin or Health Services Support to resolve. If you are unsure whether this may be the case, please reach out to us. This process will result in your file being reviewed from all perspectives; we recommend that claim numbers, dates, all correspondence, as well as phone calls, be reported and identified. This will be the highest level of review we have been able to source and therefore ask that you are as detailed and specific as possible to better enable the Plan Manager to resolve your problems as quickly and efficiently as possible.- Your Health Services Team

-

Should I claim via MSH or Tricare?

CAF members are not participants in the Public Service Health Care Plan (PSHCP), so should never claim any medical expenses through Allianz. CAF members, for the most part, are covered by Tricare (Administered in the West by Health Net Federal Services, and in the East by Humana).

CAF dependents, however, are PSHCP participants, so they may need to claim medical expenses through MSH International. Remember, in Canada, family members have access to supplemental coverage (it supplements provincial plans) from the PSHCP which is now administered by Canada Life. In the US, dependents are switched to Comprehensive coverage (must be done when a member arrives at post) and MSH International administers it.

Rules of Thumb:- CAF members must use military MTFs (covered by Tricare) unless pre-authorized by CAFMLO or 1-800-TRICARE to use external services or obtain care on the economy (some CAF members do not have access to MTFs).

- Dependents: Strongly advised to use military MTFs where you have access to MTFs – Tricare is the Primary Insurer if Tricare approves the medical expense, with residual amounts (co-pays/cost-shares) being claimed afterward through MSH. Dependents who do not have access to MTFs or Tricare will typically use the PSHCP as their primary insurance (unless they have access to other health insurance).

- Your US OUTCAN HS Team (Bulletin #2201 - Updated Jan'24)

-

Plan Number for MSH International Registration

For folks having difficulty registering with MSH International, a few OUTCAN families have provided guidance based on their experiences surrounding problems with the Plan Number.

Spousal and dependant Plan Numbers are based on the member's date of birth.Member's Birth Month Plan Number January, February, March 52111 April, May, June 52112 July, August, September 52113 October, November, December 52114

Canada Life Member Certificate Number

As a spouse or dependant, your Canada Life Health Plan Certificate Number may only show one of the 5-digit numbers listed above whereas the CAF Member's Plan Certificate Number will be up to 10 digits long, starting with an alphabetical letter - e.g., E000796638.

Plan Number for MSH International Registration

To successfully register with MSH International, you have to add a zero (0) in front of the spousal or dependant plan number and remove the alphabetical letter, replacing it with a zero (0), from the member's number. Please see the example below -- Spousal or Dependant Plan Number: 52111

- Member's Plan Number: E000796638

- Plan Number for MSH International: 052111-0000796638

-

Steps for Submitting a Claim to Canada Life / MSH International

.png)

-

TRICARE Changes in 2024

It has come to our attention that changes are coming to Tricare in 2024 that may impact CAF members and their families. There should be no impact on healthcare delivery; however, anytime there is change, there is the potential for disruption. Therefore, people need to be aware of these changes.

The Defence Health Agency (DHA) has awarded new contracts for regional support of Tricare East and Tricare West. Tricare West will have a new Managed Care Support Contractor (MCSC) – essentially, Health Net Federal Services will be replaced by TriWest Healthcare Alliance Corporation (much like how Canada Life replaced Sunlife as administrator for the Public Service Health Care Plan). Tricare East will retain Humana Military as it MCSC. However, this change will likely not take place until at least 2025. here are some changes, however, that may take place as early as 1 January 2024.

6 states may be shifted from Tricare East to Tricare West on this date:- Arkansas

- Illinois

- Louisiana

- Oklahoma

- Texas

- Wisconsin

If there are questions or concerns, we highly recommend that CAF members and their families contact the local Tricare Operations personnel at their local MTF.

- Your US OUTCAN HS Team (Bulletin #2308) -

Vacation Coverage Outside of the US

Firstly, all routine medical care should be completed prior to travel – any medical care sought on vacation should generally be urgent/emergency care for acute illness/injury.

CAF members have access to Emergency Medical Care Coverage while traveling via Blue Cross (Tricare will not cover medical care received outside CONUS/Alaska/Hawaii/Thule) – instructions can be found at the Medavie Blue Cross site: https://www.medaviebc.ca/en/members/welcome as well as on the back of your Blue Cross card. In Canada or US, attempts should be made to utilize military MTFs (if appropriate to the situation).

Families of CAF members posted to the US must be enrolled in Comprehensive coverage with the Public Service Health Care Plan (PSHCP) as administered by MSH International – this is their coverage no matter where they are in the world (even when they return to Canada for leisure travel!!). If Emergency Travel Assistance is required, call 1-833-774-2700 (in North America) or call collect 1-365-337-7427 in all other countries.

Rules of Thumb:- Families newly posted to the US may want to verify positive enrolment with Comprehensive coverage by contacting Canada Life. If you are not positively enrolled with Comprehensive coverage within 10 weeks of arriving in the US, contact your OR to determine if you need to resubmit the required documentation. Regardless of the status of your positive enrolment, you are AUTOMATICALLY covered the month you departed from Canada, but submitting claims may be more difficult without confirming enrolment.

- A consultation with your primary care provider/travel medicine clinic is routinely recommended in advance of international travel.

- Your US OUTCAN HS Team (Bulletin #2202 - Updated Jan'24) -

Medical Coverage for Adult Dependants

Kids off to school? Some things you need to consider with respect to coverage.

- Tricare Eligibility: For those with access to Tricare coverage, children only have “dependent status” (thus eligibility for Tricare) until age 21; the day they turn 21, they are ineligible for Tricare unless attending an approved institution of higher learning (i.e., college, university, etc.) – in this case, they are eligible until age 23. Please see more information/conditions here.

- PSHCP Eligibility: PSHCP is similar, with eligibility until the day a child turns 21. However, PSHCP eligibility is extended for those attending an accredited secondary institution and who are under the age of 25. Eligibility criteria are found here.

Many have children who head back to Canada for school – coverage is as above.

Dependents headed back to Canada to attend school are covered by the PSHCP. However, they lose access to Comprehensive coverage after 3 months of being in Canada to attend school. Therefore, children headed back to Canada need to enroll in a Provincial insurance plan and then positively enrolled in PSHCP Supplementary coverage. From the PSHCP Directive: "Any dependant who resides in Canada other than on a temporary basis (i.e., for more than three months) is ineligible for Comprehensive Coverage and must entrol in a provincial/territorial health insurance plan. However, the dependant will have Supplementary Coverage if eligible and if the member is paying family contributions for Comprehensive Coverage."

If your child is attending a university anywhere other than in Canada, and you are still in the USA with access to Comprehensive coverage, then that child has Comprehensive coverage under the PSHCP as well (but may lose Tricare coverage if not in the USA). See “Families with both Supplementary and Comprehensive Coverage” on the PSHCP Directive site for other iterations of this policy: here.

While we are not insurance experts, we do our best to assist understanding policies in place during your posting to the USA. If there are any questions regarding coverage, please contact your local BCAC (Tricare questions) or Allianz (PSHCP questions) directly.

- Your US OUTCAN HS Team (Bulletin #2302) -

Navigating Dental & Vision

Dental - All dental care for spouses and children must be arranged with a local dental provider. The coverage your family has will be the same as in Canada with Canada Life (formerly known as Great West Life). Make sure to check with the dental provider to see if they will direct bill for you! Check out the FAQ below for more details.

Vision - For family members, optical services in the US can be costly. Your insurance coverage remains the same as in Canada; however, while OUTCAN it's billed through MSH International. Since the cost of vision care in the US is generally higher, the out-of-pocket expenses will be higher for the family. It is recommended that if glasses or contacts are required for the family, consideration should be given to obtaining them prior to departing Canada.

Public Service Health Care Plan -

Immunization Requirements for Children

Immunization records must be obtained from your family doctor in Canada for any dependent child who will accompany you and will be attending a US school. Ensure the record shows the day, month, and year the immunization was given. You are also encouraged to contact your applicable school district in the US during your HHT to determine what immunizations are required.

CAF members, spouses and children are also able to get vaccinations at any US Base Hospital that offers them. There is no cost for these as they are done through TRICARE. If there is not a US Military Hospital installation in your area, then any doctor or pharmacy can be used, but you will be using Allianz for your insurance provider. Allianz will cover 80% of the cost of immunizations and the additional 20% can be submitted to CDLS(W) for reimbursement.

Immunizations are done differently in the US.

Here are some of the State Vaccination Requirements.

- State and local vaccination requirements for daycare and school entry are important tools for maintaining high vaccination coverage rates, and in turn, lower rates of vaccine-preventable diseases (VPDs).

- These laws often apply not only to children attending public schools but also to those attending private schools and day care facilities. States may also require immunization of healthcare workers and of patients and residents of healthcare facilities.

- All states provide medical exemptions, and some state laws also offer exemptions for religious and/or philosophical reasons. State laws also establish mechanisms for enforcement of school vaccination requirements and exemptions.

- Find Vaccination Requirements for your state and school district

When travelling on an HHT, it is recommended that you bring your children’s immunization records with you. They are required for new school registration.

Your child may be required to have specific immunizations to attend school or daycare at your new US location that is not on the provincial timeline of the Canadian province that you reside in. If that is the case, you may not be able to receive an immunization at a public/community health unit. Unfortunately, they are required to follow the provincial immunization timeline and not make any changes or exceptions. There are 2 options to get your child the immunizations required for your new post:

- Make an appointment with your child’s family doctor and ask if they can order in the required immunization and arrange to administration. If this is possible, the immunization will be billed as a prescription through your healthcare insurance and the administration may be scheduled at their office or through a pharmacy.

- Wait until you arrive at your new US location and get the immunizations there. It is recommended that CAF families utilize their local base hospitals/MTFs for immunizations. There are no fees and record keeping will be stored in one place.

Check out our Immunizations FAQ for more information! -

Having a Baby in the US

Having a baby in the US may be a complicated process. Your child(ren) born in the US will automatically have dual citizenship. But it will require some extra paperwork.

So where do you start to get your child(ren) Canadian Citizenship? They are already Canadian! You only have to get proof of that, which is called a Canadian Citizenship Certificate.

- Having a Baby in the US FAQ

- Car Seat Regulations FAQ (US & Canada)

- Application for a Citizenship Certificate for Adults and Minors (Proof of Citizenship)

-

Returning to Canada

Heading back to Canada this APS? Some things to remember with respect to medical records.

Medical Records- CAF Members: Please visit your MTF and request a copy of your entire US medical record (you will most likely have to place a separate request for your Behavioural Health file) representing your entire posting to the USA; these can either be sent to MS Pela (natalia.pela@forces.gc.ca) for entry into CFHIS or hand delivered to the medical records section at your next unit.

- Dependants: Should request their medical records as above and retain them for delivery to the nex care-providers in Canada.

- OUTCAN Pers: The HS team has no ability to enter dental records into CFHIS (Dental Officers use a different electronic record to maintain your dental files). Dental records should be requested from your US dental providers for delivery to your Canadian dental providers upon return to Canada.

IMPORTANT** The HS team regularly receives requests from personnel who have returned to Canada who neglected to do this and it is impacting future care/Release/VAC plans. It can be administratively challenging to recover this information once you have returned to Canada, so it is highly recommended that you add this to your list of departure administration.

- Your US OUTCAN HS Team (Bulletin #2303)

Dependant Scenarios

These scenarios reflect the changes to the Primary and Secondary Insurer > > Note: For any Emergencies, call 9-1-1 or report to the nearest Emergency facility. If you are a TRICARE beneficiary, contact 1-800-TRICARE (1-800-874-2273) ASAP to let them know you are in the ER. If you are not currently a TRICARE beneficiary, provide the ER with your Canada Life/MSH International information, but advise them that direct billing may not be possible.

-

Scenario #1 - Awaiting TRICARE Access

Mrs F has just arrived in Washington, D.C. with her children and Reg Force spouse. She will eventually have TRICARE access but has not completeled the DEERs enrollment process yet, so has no yet recieved base access. She feels she may have a urinary tract infection and wants to be assessed.

Suggested:

Without TRICARE benefits, Mrs F has her comprehensive coverage through the Public Service Health Care Plan (PSHCP) which is administered in the US by MSH International. However, TRICARE benefits are effective on the COS date on the posting message, sodependants can retroactively file claims with TRICARE as well:- She should book an appointment at a local clinic (i.e., walk-in or local clinic).

- Clinician asseses and prescribes an antibiotic medication.

- Mrs F pays out of pocket for clinic services prior to leaving clinic, keeping all invoices and receipts.

- Mrs F goes to a local pharmacy to get her prescription filled, pays out of pocket, and keeps a copy of the prescription and receipt.

- Mrs F submits claim for clinic access and prescriptions to MSH International using the MSH International portal OR if she manages, in the meatime, to get access to TRICARE, she can claim manually through TRICARE as well.

- If MSH International returns an Explaination of Benefits (EOB) with an R70 amount (an amount that may account for the higher cost of medical care in the USA), dependents can usually claim these amounts through CFSU(CS) or CDLS(W), which will be reimbursed as per Military Foreign Service Instructions (MFSI). If she chose to claim retroactively through Tricare at a later date, she would claim any co-pays/cost-shares through MSH International next.

-

Scenario #2 - No TRICARE Access

Ms P has accompanied her spouse to New York City on a United Nations Posting, will not have access to US Military Medical Treatment Facilities (MTFs) during her posting, so has no TRICARE access. She is 16-weeks pregnant and is concerned about how to pay for childbirth when the time comes.

Suggested:

Without TRICARE benefits, Ms P is dependent on her Comprehensive coverage through the Public Service Health Care Plan (PSHCP) which is administered in the US by MSH International:- Ms P should locate a clinician for her perinatal care. If possible, she should coordinate direct billing (electronically, via fax/email, otherwise) to MSH Int. through the clinic manager (who may need to contact MSH Int. for assistance). If clinic is unable to bill MSH Int directly (which may be an issue with MSH International for the time being), Ms P can pay and claim later via the MSH International portal.

- Prior to delivery, Ms P should attempt to get a predetermination from the provider on how much the delivery will cost (including admission to hospital as required). Childbirth in the US is expensive and if unable to bill MSH International directly, she may be advised to request an advance, through her spouse, from CFSU(CS) or CDLS(W) to pay for the delivery. CDLS(W) advances $70,000.00 USD to Ms P’s spouse.

- Healthy baby delivered. Hospital provides a bill for $65,000.00 USD, which Ms P pays using the advance received from CDLS(W).

- Ms P then submits a claim using the MSH International portal to be reimbursed the $65,000.00 USD.

- MSH International reimburses Ms P $60,000.00 USD for the costs of her delivery. The Explaination of Benefits (EOB) states an R70 amount of $5,000.00 USD.

- Ms P, through her spouse, pays the remaining balance of the advance to CDLS(W).

-

Scenario #3 - TRICARE & MTF Access - Outpatient Care

Mr Q accompanied his spouse to Colorado Springs. He has a dependant ID card, access to the base and has registered at the MTF. He wants to see a clinician regarding his shoulder pain. He books an appointment with a primary care clinician.

Suggested:

With MTF access and TRICARE benefits, TRICARE is the Primary Insurer for Mr Q; the PSHCP, administered in the US by MHS International, is the Secondary Insurer.- Mr Q is assessed at the clinic by a primary care clinician.

- Clinician prescribes a medication for pain relief.

- Mr Q leaves doctor's office and goes to the MTF Pharmacy to retrieve his medication.

- Mr Q returns home. There should be no bills for any care/medications recieved.

-

Scenario #4 - TRICARE & MTF Access - Specialist Referral on Base

Mr Q is still having shoulder pain and some functional loss of renge of motion. He returns to his clinician regarding his ongoing shoulder pain and an xray reveals a should defect. His clinician refers him to an Orthopedic Surgeon in the MTF for a consult.

Suggested:

With MTF access and TRICARE benefits, TRICARE is the Primary Insurer for Mr QQ and the PSHCP, administered in the US by MSH International, is the Secondary Insurer.- Mr Q waits 72hrs for the referral to be approved by the Referrals Manager on base.

- The referral is approved, so Mr Q books an appointment with Dr T, Base Othopedic Surgeon.

- Mr Q attends the appointment and opts for surgery. Surgery date at the MTF is booked.

- Operation goes well. Mr Q goes home the same day (no hospital admission). LCol Q drives Mr Q home. There should be no bills for any care/medication recieved as TRICARE should cover all aspects of this care.

-

Scenario #5 - TRICARE & MTF Access - Off Base Referral

Mrs H is posted to Tacoma, WA with her Reg Force spouse. She thinks that she may have some issues with anxiety and coping with stress so books an appointment with her primary care clinician, Dr L, at the base MTF. Dr L is concerned as well. Mrs H agrees to be seen by a Social Worker, but there are limited Social Work services on base at this time. So, Dr L refers her to a civilian Social Worker who is in the TRICARE network off-base.

Suggested:

With MTF access and TRICARE benefits, TRICARE is the Primary Insurer for Mr Q and the PSHCP, administered in the US by MSH Int., is the Secondary Insurer.- Mrs H wait the 72hrs for the referral to be approved by the Referrals Manager on base.

- The referral is approved, so Mrs H books an appointment with the off-base civilian Social Worker.

- Mrs H tells the Social Work clinic that TRICARE is to be billed directly (as the clinic is registered on the TRICARE Network, direct billing to TRICARE should not be an issue).

- Mrs H does not have an Other Health Insurer (OHI) - TRICARE does not recognize MSH Int as an OHI, so Mrs H will not need to disclose this.

- Mrs H is seen by the Social Worker. Additionally, Mrs H goes on to have 10 more sessions until her treatment is considered complete.

- Mrs H receives a bill in the mail for each therapy session. Each therapy session costs $110 dollars, of which TRICARE pays $80.00 USD, leaving Mrs H with a $30.00 USD co-pay.

- Mrs H pays the $30.00 USD Co-Pay to TRICARE, keeping all invoices/receipts.

- Mrs H submits a claim for the co-pay to MSH Int. and receives the equivalent of $30.00 USD from them.

- If there is an R70 amount on the EOB from MSH Int., Mrs H can claim that through CFSU(CS) claims section.

-

Scenario #6 - TRICARE & MTF Access - Admission at Civilian Hospital (Childbirth)

Mrs B has accompanied her spouse to Kansas and is 16wks pregnant. She was referred off base for her perinatal care and sees an Obs/Gyn physician who is registered on the TRICARE Network. TRICARE, up until this point, has paid for all of her care up to the point of delivery as all of her appointments have been considered Outpatient Services. Mrs B is scheduled for a C-Section at a civilian hospital and knows that she will require to be admitted to the hospital (Inpatient Services).

Suggested:

Kansas is NOT a Reciprocal Health Care Agreement (RHCA) State (only California, Georgia, Hawaii, Maryland, North Carolina, Texas, Virginia, Washington, and the District of Columbia are). In these locations TRICARE will generally NOT cover the costs of a dependent’s admission to a civilian MTF. With MTF access and TRICARE benefits, TRICARE is the Primary Insurer for Mrs B for all Outpatient Services (no admission to hospital required). However, be advised, TRICARE will not pay for admission to civilian hospitals for dependants.- As this requires an admission to hospital, TRICARE will not cover costs and the hospital billing department should be told this as their default may be to try and bill TRICARE. They still may, but Tricare will most likely decline to pay, and you will receive a bill in the mail for the admission from the hospital.

- Prior to delivery, Mrs B should attempt to get a predetermination from the provider on how much the delivery will cost (including admission to hospital as required). Childbirth in the US is expensive and if unable to bill MSH Int. directly she may be advised to request an advance, through her spouse, from CDLS(W) to pay for the delivery. CDLS(W) advances $70,000.00 USD to Mrs B’s spouse.

- Healthy baby delivered. Hospital provides a bill for $65,000.00 USD, which Tricare will decline. Mrs B pays the hospital using the advance received from CDLS(W).

- Mrs B then submits a claim using the MSH Int. portal to be reimbursed the $65,000 USD.

- MSH International reimburses Mrs B $60,000.00 USD for the costs of her delivery. The EOB states an R70 amount of $5,000.00 USD.

- Mrs B claims the R70 amount through MFSI funds by submitting claim to CDLS(W) Med Admin. Med Admin deducts the R70 amount from the advance balance.

- Mrs B, through her spouse, pays the remining amount of the advance back to CDLS(W).

-

Scenario #7 - TRICARE & No MTF Access - Off Base Outpatient Care

Mr T accompanied his spouse to Tyndall, FL. As dependants are not seen at the base MTF, Mr T receives all his care from civilian resources. Mr T thinks that he injured his hip while running and would like it to be assessed at his doctor’s office, which is registered on the TRICARE Network.

Suggested:

Without MTF access but still in receipt of TRICARE benefits, TRICARE is the Primary Insurer for Mr T for all Outpatient Services. The PSHCP, administered in the US by MSH Int., is the Secondary Insurer.- Mr T books an appointment with his civilian doctor, Dr Z, who is preferably registered with the TRICARE Network. He has removed his previous OHI information from the clinic and has told them that TRICARE is the Primary Insurer.

- Mr T attends his appointment.

- Mr T receives a bill in the mail for his appointment, which cost $300 USD, of which TRICARE pays $280.00 USD, leaving Mr T with a $20.00 USD co-pay.

- Mr T pays the $20.00 USD Co-Pay to the provider, keeping all invoices/receipts.

- Mr T submits a claim for the co-pay to MSH Int. and receives the equivalent of $20.00 USD from them.

- If there is an R70 amount on the EOB from MSH International, Mr T can claim that through CFSU(CS).

-

Scenario #8 - TRICARE & MTF Access - Admission to MTF (RHCA State)

Mrs C has accompanied her spouse to Norfolk, VA and is 16wks preganat. She receives perinatal care on base and is expected to deliver her baby at the base hospital.

Suggested:

Virginia is a Reciprocal Health Care Agreement (RHCA) State (along with California, Georgia, Hawaii, Maryland, North Carolina, Texas, Virginia, Washington, and the District of Columbia). In these locations, and these locations only, TRICARE will cover the costs of a dependent’s admission to a military MTF. With MTF access and TRICARE benefits, TRICARE is the Primary Insurer for Mrs C for all Outpatient Services (no admission to hospital required) and Inpatient Services (hospital admission).- Mrs C delivers a healthy baby at the base MTF and is admitted for 3 days.

- Mrs C and baby return home on the 4th day.

- TRICARE pays the costs. Mrs C receives a bill from the hospital for $65 USD for “subsistence fees”. TRICARE does not cover subsistence fees (i.e., meals), so Mrs C pays these.

- Mrs C then submits a claim using the MSH Int. portal to be reimbursed the $65 USD.

- MSH International reimburses Mrs C $65 USD. If MSH int. does not reimburse these fees, then Mrs C can submit a claim for subsistence fees reimbursement thorough CDLS(W) Med Admin.

-

Scenario #9 - TRICARE & MTF Access - Admission to MTF (Non-RHCA State)

Mr E has accompanied his spouse to Colorado Springs and is being seen at the MTF for knee problems. He receives physio and other care on base but has now decided for knee replacement surgery at the base hospital, which will be accompanied by an admission for approximately 3 days.

Suggested:

Colorado is NOT an RHCA State (only California, Georgia, Hawaii, Maryland, North Carolina, Texas, Virginia, Washington, and the District of Columbia are). In these locations TRICARE will generally NOT cover the costs of a dependent’s admission to a military MTF, but the costs may be much cheaper than at a civilian facility. With MTF access and TRICARE benefits, TRICARE is the Primary Insurer for Mr E for all Outpatient Services (i.e., physio - no admission to hospital required) and MSH International is the Secondary Insurer. However, for all Inpatient Services (hospital admission, including the surgery as it is the reason for admission), you will most likely require the PSHCP to cover the costs.- Mr E will not need to pay for any pre-surgical care as this should be considered Outpatient Services and is covered by TRICARE. He should not receive any bills for these services.

- Mr E should discuss surgery with the MTF (Benefits Counselor, or Health Benefits Advisor) and confirm that an admission to the MTF for surgery will not be covered by TRICARE. He should get a predetermination of the costs and request an advance from CFSU(CS) if required (ie the MTF won’t bill MSH International directly.

- Mr E undergoes successful surgery at the base MTF and is admitted for 3 days.

- Mr E returns home on the 4th day. He receives a bill from the Hospital as TRICARE refused to cover the costs of his admission. Mr E pays the bill.

- Mr E then submits a claim using the MSH International portal to be reimbursed the costs of surgery and admission to the hospital.

- MSH International reimburses Mr E the entire amount.

- Mr E reimburses the CAF for any advanced funds, if required.

Information for CAF Members

-

Eyewear for CAF Members

Ref: CFHS Instr 40020-05 Optical Supplies and Services

The intent of this bulletin is to clarify the means by which OUTCAN CAF members can purchase eyewear. CAF members are generally only eligible to purchase eyewear every 2 years - any purchase made prior will not be reimbursable.

Procedure- Log on to your Blue Cross Portal (www.medavie.bluecross.ca/myinfo) to determine when your last eyewear purchase was. You must purchase your new eyewear after 2 years has passed from the date listed in your portal.

- Contact the CAFMLO for approval to purchase eyewear. Once approval is provided, you can purchase eyewear as be ref. Generally, there is no entitlement to purchase contact lenses.

- Submit claim (consisting of CAFMLO approval, invoice, receipts and CF52 claim form) to the HS Med Admin inbox: CDLSW-MedicalAdmin-ELFCW-AdminMedical@forces.gc.ca.

Important- Pers requesting any eyewear (i.e., regular glasses, sunglasses, BEW inserts, etc.) should read ref first, and then follow up with the CAFMLO.

- The entitlement is for 2-years despite lost/broken eyewear OR change in prescription. Only eligible eyewear will be reimbursed (as per ref).

- You are entitle to a max reimbursement of $375 CAD - members will be out of pocket for expenses beyond their entitlement.

- Members with access to an MTF shall use MTF optical services for eye exams. Members requiring civilian resources for optometry exams need justification and authorization from the CAFMLO (or Tricare) prior to using civilian optical services.

- Your US OUTCAN HS Team (Bulletin #2205) -

Completing and Submitting your Periodic Health Assessment (PHA)

CoCs use the Medical Category to assess the employability of their members; as such, the medical category needs to be updated at regular intervals based on age and/or job role. Being posted OUTCAN does not negate the need to have a valid medical category. Therefore, CAF members are responsible for conducting an appropriate Periodic Health Assessment (PHA) with their US clinicians and providing the info from the PHA to the CAF Medical Liaison Officer to perform the update.

Non-Aircrew: Essentially, CAF members need to update their medical category every 5 years up until age 40, after which it must be done every 2 years. When scheduling a PHA, ask your clinic to schedule a complete medical (head-to-toe exam), vision testing (must have numbers, ie 20/20, indicating visual acuity), and audiogram (must have frequencies and decibels). Additionally, you should fill out a DND2552 Medical Questionnaire (available on Defence Forms Catalogue, from your OR, or from the HS team). Send the clinical notes and DND2552 to the CAFMLO (encrypted via email, via DoD Safe, or fax) in order to have your medical category updated. IMPORTANT: if screening for a cross-posting/extension, you must have a valid medical category within 2 years, regardless of age.

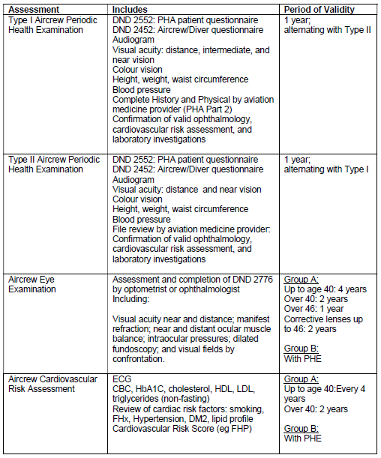

Aircrew: Active aircrew (those who are in flying or controlling positions) are usually familiar with timelines for Type 1 or Type 2 aircrew medicals, the details of which are outlined in AMA Directive 100-01 Medical Standards for CAF Aircrew. However, aircrew posted to the USA for greater than 2 years in non-flying/non-controlling positions can waive aircrew medicals and revert to a Non-Aircrew PHA (see above). All aircrew were required to have a valid Type 1 Aircrew Medical Exam prior to departure from Canada.

While US Flight Med clinicians clear CAF members to fly/control according to US policies (usually through issuance of a DD2992 Medical Recommendation for Flying form), Aircrew PHAs must also be conducted in order to maintain a valid medical category, with particular attention to the Air Factor. Aircrew should request specific examinations based on the Period of Validity found in the table below; if there are questions on what is required, aircrew can reach out to the CAFMLO for clarification on specific exam requirements. Aircrew are reminded that along with clinical notes from the exam, they are to provide DND2452 and DND2552 medical questionnaires to the CAFMLO in order to update their medical category; submissions consisting solely of DD 2992s are not sufficient. The CAFMLO does not require the 2992 form.

- Your US OUTCAN HS Team (Bulletin #2203)

-

Screening Instructions for Extensions or Cross-Postings

IMPORTANT** Screening cannot take place if the member does not have a valid medical category stemming from a Periodic Health Assessment (PHA) within the last 2 years, regardless of age (1 year for active aircrew). A valid medical category is required to action any OUTCAN screening request (please see further guidance on updating your medical category on this website).

Extensions

The CAF Medical Liaison Officer (CAFMLO) is the final medical review authority; these files will not be sent to D Med Pol.

Members need to provide the following to the CAFMLO:- a copy of the DND 4064 so that we can confirm screening type, dependants and losing CO approval (CO needs to approve extension prior to any medical review);

- members/dependants will require a Social Work screen, which the HS team will book with a CAF-employed Social Worker using information found in the 4064. Use of US Social Workers is not authorized for OUTCAN screenings;

- annex B of 5020-66 with parts 1 and 2 completed and signed by member (and spouse, if applicable); and

- DND 4342 (Statement of Dependant Health) forms completed for each dependant. As this is an extension, please complete sections 1 and 2; the CAFMLO will review and complete Section 3 (review by dependant's family physician not required).

Items that are not required for an extension screening include:- Phase 1 Part 4 Dental; and

- Phase 1 Part 6 Immunization review (other than COVID-19 vaccines)

Cross-Postings within the US

The CAF Medical Liaison Officer (CAFMLO) is the final medical review authority; these files will not be sent to D Med Pol.

Members need to provide the following to the CAFMLO:- a copy of the DND4064 so that we can confirm screening type, dependants and losing CO approval (CO needs to approve extension prior to any medical review);

- member/dependents will require a Social Work screen, which the HS team will book with a CAF-employed Social Worker using information found in the 4064. Use of US Social Workers is not authorized for OUTCAN screenings;

- annex B of 5020-66 with parts 1 and 2 completed and signed by member (and spouse, if applicable); and

- DND 4342 (Statements of Dependant Health) forms completed for each dependant. Please complete sections 1 and 2; the CAFMLO will review and complete Section 3 (review by dependant’s family physician not required).

Items that are not required for an extension screen include:- Phase 1 Part 4 Dental; and

- Phase 1 Part 6 Immunization review (other than COVID vaccines).

Once the file is reviewed, Phase 1 Part 8 will be signed and returned to the OR. For the signatory requests please include the Med Records Clerk for the Medical Records portion and the CAFMLO as the Medical Officer. The CAFMLO will personally contact the member's CO to discuss any status other than GREEN.

Cross-Posting outside the US

D Med Pol is the final medical review authority; however, the CAFMLO must provide level 4 review prior to the file being sent to D Med Pol.

Members need to provide the following to the CAFMLO:- a copy of the DND4064 so that we can confirm screening type, dependents and losing CO approval (CO needs to approve extension prior to any medical review);

- an Immunization screen will be required for members/dependants and will be coordinated by the HS team;

- member/dependants will require a Social Work screen, which the HS team will book with a CAF-employed Social Worker using information found in the 4064. Use of US Social Workers is not authorized for OUTCAN screenings;

- annex B of 5020-66 with parts 1 and 2 completed and signed by member (and spouse, if applicable);

- DND 4342 (Statements of Dependant Health) forms completed for each dependent; Note: section 3 of each 4342 form must be completed by the dependant’s family physician (CAFMLO will not sign these forms);

- proof that all eligible dependents have been “fully vaccinated” against COVID19; and

- members and dependants will require a full dental screening as per instructions found in Phase 1 Part 4 of ref B; this screen should be included in the 4064 sent to the CAFMLO.

Once the Phase 1 screening components are complete (dental, immunization, and social work), the CAFMLO will review the file and forward it to D Med Pol for phase II final medical review. -

Submitting Med Records / Contacting the CAFMLO Team

The intent of this bulletin is to clarify the means by which the CAF members of the US OUTCAN community should submit documents for entry into CFHIS. Dependents of CAF members are not required to submit any medical documentation unless specifically requested by the CAFMLO (ie for screening purposes). Due to US privacy laws, the HS team can’t access your US Medical records; you are requested to either provide them to us, or authorize the US medical system to do so.

Clinical Notes: After a clinical encounter that requires clinical notes to be sent to the CAFMLO, members should request a copy of their notes (either with clinic reception or Med Records). The clinic may ask you to fill out and submit a DoD 2870 Authorization for Disclosure of Medical or Dental Information. Your clinical information can then be sent to the HS team though various means.

Email: Email directly to CAFMLO or Health Care Records Clerk (see website for current contact info). Most popular option, especially if one has access to your MHS Genesis Portal - your medical records can be downloaded and then sent to CAFMLO. Otherwise, you can retrieve your medical records from the MTF Records section.

Fax: Fax to 1-202-448-6438 (useful if using a DoD 2870 form, but can be slow.

DoD Safe: Enquire at the MTF if they can use DoD Safe to email the notes directly to the CAFMLO (great for large files). The MTF will provide instructions

Mail to:

CF H Svcs HQ Det Washington

501 Pennsylvania Ave NW Washington, DC 20001

Attn: CAFMLO

Mailing is good if the clinic provides a CD (make sure a password is included!)

Please DO NOT send medical records (other than claims/vaccines) to the following inboxes:- CDLSW-MedicalAdmin-ELFCW-AdminMedical@forces.gc.ca (used for claims)

- HSSOUTCANUS-SSSHORSDUCANADAEU@forces.gc.ca (used for vaccines)

- Your US OUTCAN HS Team (Bulletin #2204)